Welcome to the official blog of the Law Office of David A. Fernandez! We hope that this entry will be followed by many others in the coming weeks, months and years. We are a law office in East Houston TX with a practice in debt defense and bankruptcy. We have many years of experience representing our clients.

We want you, our readers and current or potential clients, to have a full understanding of the law. The more you know about your rights, the better prepared you will be to resolve land disputes with our help. Every so often we will share important news and insights related to the legal issues you’re facing.

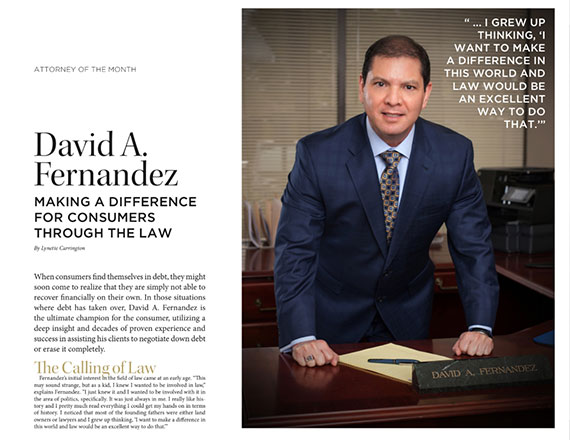

In future entries to this blog we will tell you a little more about ourselves, and we will try to pass on some knowledge regarding our areas of practice. Hopefully, we can impart some useful information that you will look forward to reading. Please check back on this blog for future updates. And if you need info about debt defense and bankruptcy in the Houston TX area, please call our attorneys