Houston Debt Defense Litigation Attorneys Fight for Your Rights

Vigorous defense against debt collection lawsuits in Texas

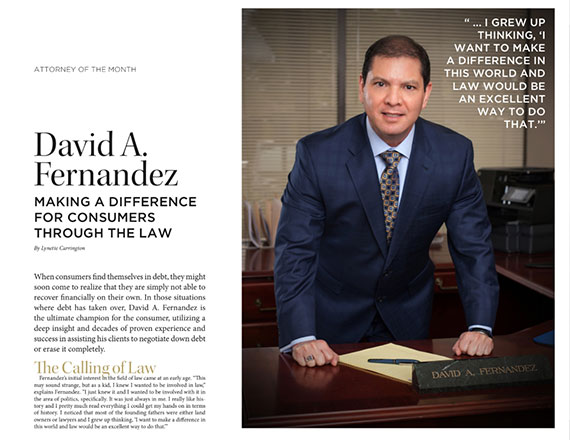

Facing a credit card or debt collection lawsuit is a frightening experience. It feels like your debt keeps growing and that the angry letters and harassing phone calls will never stop. When you’re angry with collectors or scared about your future, you want an attorney who will defend you relentlessly in the courtroom. You want an attorney who won’t back down. You will find such an attorney at the Law Office of David A. Fernandez, P.C., in Houston.

Relentless defense lawyers protecting debtors’ rights

Our law firm is founded on the proposition that all people have the right to live in dignity. When abusive creditors try to rob our clients of their dignity, we are determined to provide relief. Past clients who’ve relied on us know that we are:

- Respected — Over more than 25 years, our law practice has built a reputation for highly professional and ethical service.

- Tenacious — We do more than negotiate reductions in debt. We go to court to fight on your behalf.

- Comprehensive — As a practice that focuses on consumer protection law, we do more than just put an end to creditor harassment: we create lasting solutions to your problems.

Runaway debt takes away your autonomy and your freedom. When you're ready to take back control of your life, David Fernandez and his team will fight for you in court.