During the recession caused by the pandemic, you probably received some sort of benefit from the government, such as stimulus checks, paused student loan payments or housing-related assistance. But you may still be experiencing financial hardship because of COVID-19’s impact on the economy. If so, you should consider taking advantage of additional debt relief options offered by banks, credit unions, credit card companies and other financial providers.

Many banks and credit unions are offering COVID-19 fee waivers to customers, canceling such charges as:

- Overdraft/non-sufficient funds (NSF) fees

- ATM transaction fees

- Early withdrawal penalties for CDs

- Excess withdrawal penalties for savings accounts (fees charged for exceeding the number of withdrawals allowed for a certain time period)

Keep in mind, these fee waivers don’t usually apply to monthly maintenance fees charged for certain account types.

Many banks and credit unions are also offering some form of relief for loan customers, typically in the form of deferred payments and fee waivers. There are few things to keep in mind:

- You need to make a request — Your financial institution probably won’t give you relief automatically.

- Be sure to ask questions — How long can payments be deferred? Will you have to pay a large lump sum at the end of the deferral period? Will interest keep accruing during deferment?

- Explore various relief measures — Different institutions are offering relief for different loan types, so be sure to ask what programs are available for your specific loan, whether it’s a mortgage, car loan, line of credit, personal loan or business loan.

Credit card companies are offering several types of assistance to card holders who have been under financial stress during the pandemic. Ask your card issuer if you are eligible to receive:

- A waiver of the minimum payment requirement

- Waived late fees or refunds of late fees already assessed

- Interest rate reductions

- A hardship payment plan

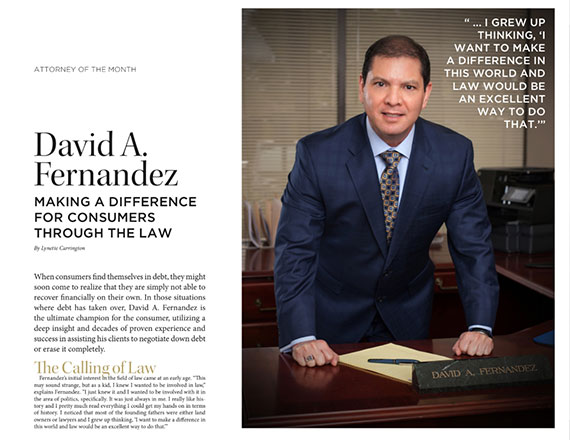

If stimulus checks and assistance from creditors aren’t enough to help you get through this difficult time, you should speak with a lawyer experienced in debt relief. At the Law Office of David A. Fernandez, P.C. in Houston, our attorneys are here to assess your situation and help you in any way we can. To get started, call 713-893-8509 or contact us online. We offer free initial consultations.