Overwhelming medical bills have long been major causes of financial hardship and the problem has worsened during the pandemic. A summer 2020 survey showed that 46 percent of respondents had outstanding medical bills and 56 percent had medical debt sent for collection at some point in their lives. Medical debt is a driving factor in two-thirds of personal bankruptcy cases.

If you are suffering with heavy medical debt, bankruptcy may be an option, but you should first consider these possible actions to address medical debt:

- Ask the hospital — Depending on your income, you may qualify for the hospital’s financial assistance policy, sometimes called “charity care.” If you qualify, your bills could be partly or wholly forgiven.

- Don’t pay with credit cards — Medical providers might be pushing you to pay your medical bills with a credit card. But all you’re doing is refinancing the debt, on which you will have to pay interest.

- Prioritize other debts — Unpaid medical bills are less damaging to your credit than unpaid mortgage or credit card bills, which should be given priority.

- Negotiate — Consult with medical providers to explore acceptable ways you can reduce debt or restructure it. Debt negotiation is best done with help from a qualified attorney.

- Ask about paying the insurance rate — Hospitals often bill at what is called the “chargemaster” rate. This is similar to the sticker price on a car. Instead of paying that full rate, ask the hospital to bill you at the rate charged to insurance companies, which is often substantially lower.

If these solutions aren’t enough to get you out from under medical debt, then it may be time to consider bankruptcy. If your income is below a certain level and you pass the means test, you could file for Chapter 7 liquidation, which erases all your unsecured debts, including medical bills, and gives you a fresh start. In some cases, a better fit may be a Chapter 13 reorganization. Your debts are consolidated into manageable monthly payments over three to five years, after which time most remaining debts are erased.

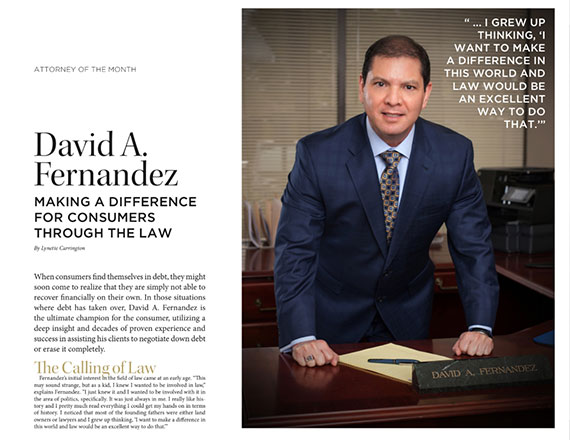

If you are struggling with medical debt, don’t hesitate to reach out to the Law Office of David A. Fernandez, P.C. in Houston. Our attorneys are passionate about getting people back on track financially. We can advise you of your non-bankruptcy and bankruptcy options to escape medical debt. Start by giving us a call at 713-893-8509 or contact us online to schedule a free consultation.