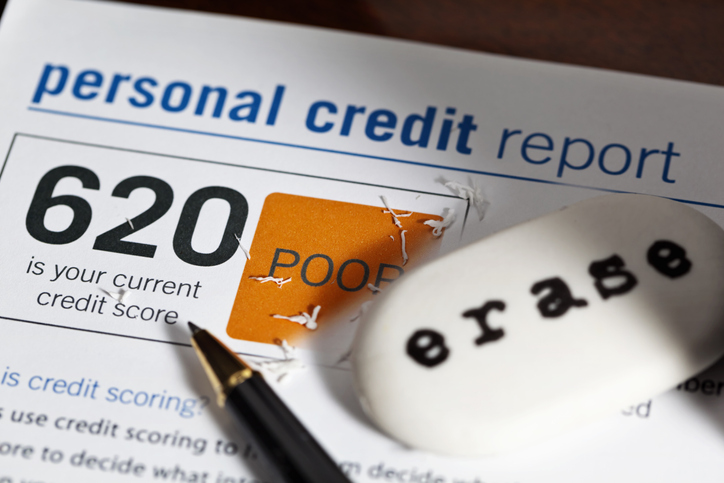

Many debt problems result from temporary situations where underlying financial problems arise from something out of the debtor’s control. A job loss, divorce, medical crisis or home repair might set you back for a few months or even longer. When the situation normalizes, you’re able to meet your obligations once again, but what about the damage to your credit rating that occurred in the meantime? Everyone wants to take negative items off of their credit report, but some things cannot be removed, and relying on a “credit repair” company that promises you the world can get you in deeper trouble.

Before you determine how to proceed, it’s important know which of the following types of negative information are lowering your credit rating.

- Inaccurate reports — Dealing with the three major credit reporting agencies (TransUnion, Equifax or Experian) regarding an inaccurate report can be very difficult, even if the error is fairly obvious. An experienced debt defense lawyer can communicated with all three credit bureaus on your behalf and threaten legal action if they fail to clear up inaccuracies in a timely manner. Depending on the circumstances, your attorney might be able to negotiate with creditors directly to resolve discrepancies and clear existing obligations.

- Accurate negative reports — Some unscrupulous “credit repair” or “debt relief” outfits try to attract clients by overstating the services they offer. They might even claim that they have the ability to remove accurate items from one’s credit report. This is not the case. The three major credit reporting agencies do make mistakes, and an experienced credit restoration attorney can help you correct them while giving you an honest perspective on your legal options.

- Duplicated or outdated reports — Creditors are usually eager to send negative information to reporting agencies, but they might not take the time to note when a debt has been resolved. In other instances, missed payments are reported twice or remain on your record longer than they should. When you work with an attorney who understands the relevant laws, you can improve your credit score by removing duplicated or old reports.

At the Law Office of David A. Fernandez, P.C., we assist clients throughout the Houston area who are looking to have negative items removed from their credit report as well as individuals seeking other types of debt relief. To schedule a free initial consultation to discuss your situation, please call 713-893-8509 or contact us online.